What is an RESP, and how does it work?

- An RESP is an opportunity to put savings toward your child’s post-secondary education. Each month money is deposited and can grow tax-free.

- The Government of Canada and some provincial governments provide grants based on how much you contribute to your child’s RESP.

- When a child starts post-secondary education, they can begin to withdraw. The student is allowed to take out the interest and the grant that has been received in the RESP. This is called Educational Assistance Payment.

- You can take out your contributions to pay for the education as well. That money is tax-free.

- As the student takes the money, there will be income tax, but the student will have a lower tax rate, which should be minimal.

What if the child does not go to post-secondary education?

- You can designate another child in the family. You can withdraw the original contributions tax-free.

- Transfer your investments income to your RRSP within the conditions allowed.

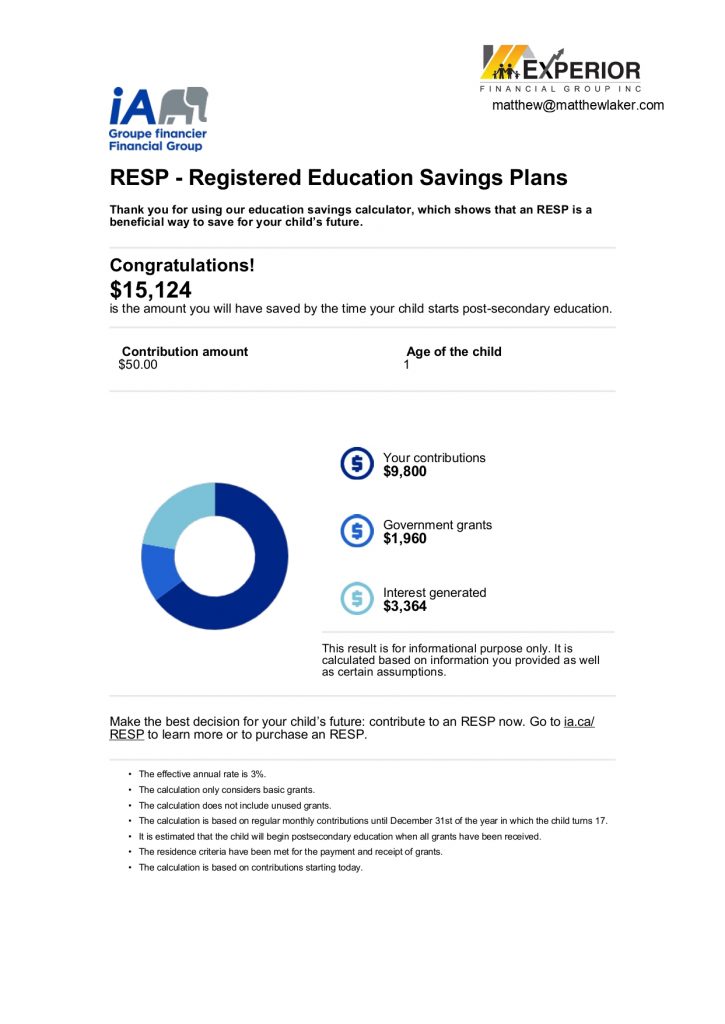

Example of an RESP

More information to help https://www.canada.ca/en/services/benefits/education/education-savings/resp.html