Webinar – 3 Question to ask when looking for life insurance

Are you looking for insurance? In this free webinar, I will discuss three questions to ask when looking for life insurance.

Are you looking for insurance? In this free webinar, I will discuss three questions to ask when looking for life insurance.

Q.Should I invest in an RRSP or TFSA?

First, let’s review RRSP and TFSA

Retirement. Many see the TFSA and think it is about savings. That is not the whole truth. An RRSP and TFSA are two great tools to plan for your retirement.

The Key to remember is with an RRSP you are differing to pay income tax to the future. The advantage there is when you go to withdraw it, you will be in a lower tax bracket. So you will pay less tax.

Money put into a TFSA has already been taxed. Any increase in your TFSA investment, you are not taxed on that. You also can withdraw tax-free.

If you are starting out and already in a lower tax bracket, start with a TFSA. The reason is this allows you to save contribution room for your RRSP when you are making a higher income.

When you put money into an RRSP, this brings down the amount of gross income you are taxed on for that year.

An RRSP is taxable when you withdraw it, and a TFSA withdraw is not taxed.

If you withdrew from an RRSP before retirement, you will lose that contribution space and have to pay taxes on it what it is taken out.

If you withdraw from a TFSA, you will not pay taxes. However, you can put the contribution limit back in the following year.

Some institutions advertise the TFSA as a saving account, but it is more than that. First, remember the purpose is retirement. Second, you can disperse the assets in the same places as a RRSP.

Both can invest in cash, GIC, savings bonds, mutual funds, ETF, equities, etc)

Remember investing should be part of a holistic financial plan.

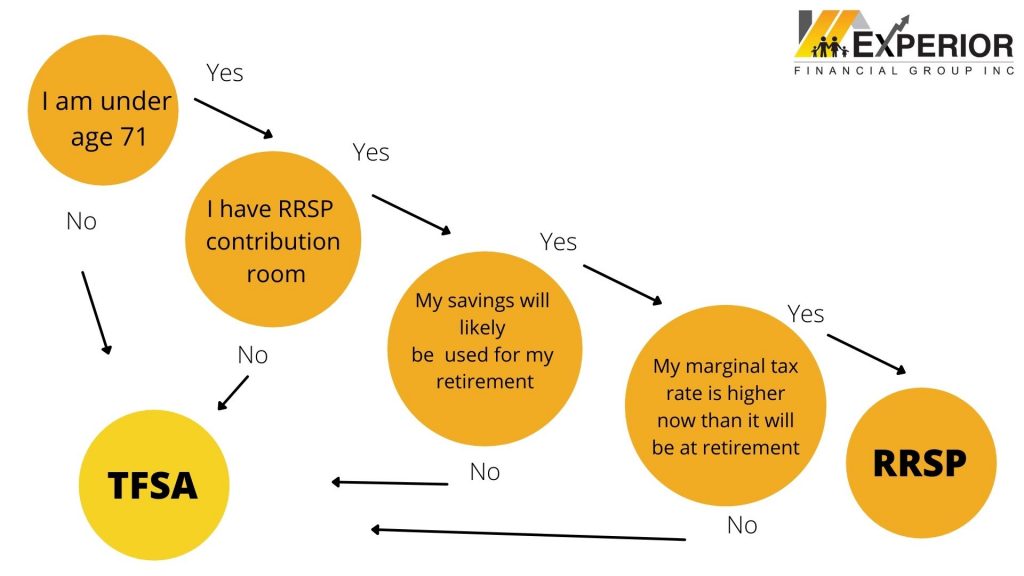

This image though not complete can give you a start in figure out which direction.

Do want to learn how you can have great returns and have a death beneficiary’s benefit on your TFSA or RRSP?

Want further help with TFSA or RRSP?

Just Got questions.

Let’s meet.

The best time to start investing was yesterday; the second-best time is today.

A simple questioner to help help you figure out what kind of investor you are as you make your retirement plans.

I did not think about this at first when I was buying a house. The mortgage insurance pays the balance of the mortgage left at the time of death. That payment goes to the bank and not to you.

What this means is you bought your house for $400 000. Let’s say there is $200 000 left. You pay the same premium throughout the diminishing mortgage, and they will cover that 200 000 left on the house when you die.

But if you got life insurance for 400 000 to cover the house in case of your death. Your beneficiary get $400 000 to direct where you or they want.

When buying mortgage insurance, you are just thinking about one debit. But what if you could step back, take a financial analysis and assess where you are at and what are your future needs and goals. Life insurance can take into account a broader range of needs and help you better protect your family. The beneficiary can be helped with funeral costs, other debt and provision for a legacy to your grandchildren.

If you change lenders, this does not mean that your insurance will move with you. That will mean an increase in cost. Your life insurance will stay with you no matter where the mortgage is.

What many people do not understand is many mortgage insurance is assessed after you die. So if there was an existing issue you may not be covered. CBC did a series on this.

When you get life insurance it is assessed as you are applying. If the policy is issued that means you have it. That is not the case with the other way.

So do you need a review of where you are at let’s talk.