3 mistakes pastors make preparing for retirement

1)Not engaging with Church/Denimonation retirement plan

To many, never take a look at the plan their church or denomination has set up for you. You need to engage and make sure you are maximizing the investment. If you can add more to it, that can significantly increase your growth and lower your current taxes.

2)Estate planning

How many funerals have you participated in? How many families have you come alongside during the end of life of an individual? Do you have your house in order? Have you an end-of-life plan and proper life insurance in place.

Even if you are young, you still need to look at life insurance and end-of-life planning. If you have a loved one depending on you, you need life insurance.

3)Chasing the return

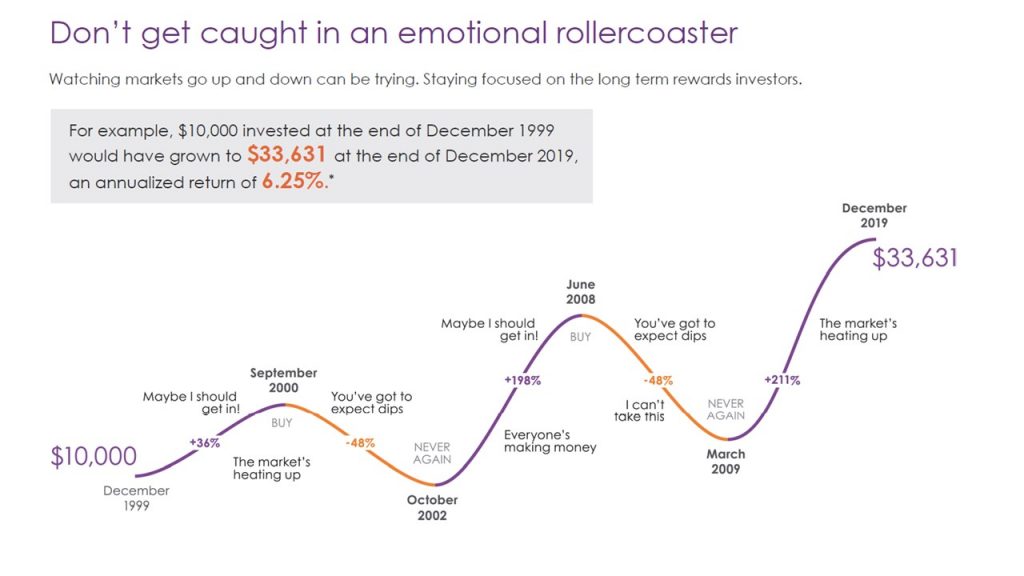

The reality is things go up and go down. We all can be guilty of Chasing the return. Trying to guess when stock will be up or down is not easy. Let’s face it you do not have time and have other focuses. You do not want to keep moving money around as this can harm you over the long run.

For a paster in the ministry, you want to find a good fund that is performing well and has a range of investments and is managed.

There is also power in setting up a PAD. That is a monthly amount of money that goes is in. You will buy when it is high, and you will buy when it is low. Remember when it is low, things are on sale, so you are getting more. Over a long period of time with a good fund, you will find a good return.

Here is a great reminder to be careful about the emotional roller coaster.

An extra thought

4)No Planning -Here is the hard truth at some point, the church is going to stop paying you. Then what, you need a plan, and you need to steward the resources that you have now. You need as well to be utilizing RRSP and TFSA.

Let’s set up a 30 min free phone and be sure to ask for the free financial complimentary analysis—no obligation to buy anything. Let’s get to know each other and what you are looking for.