Gain Financial Freedom

Experior Financial Group gives you the tools to take charge of your financial life.

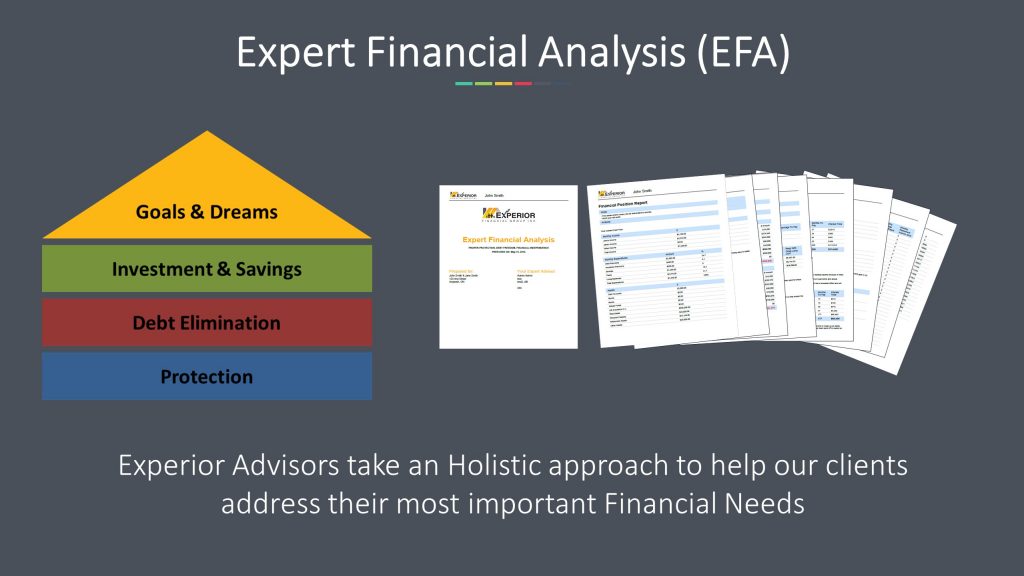

Advanced Financial Analysis Tools

Whether it’s budgeting, debt elimination, or building wealth, developing a financial strategy with the expert financial analysis gives you an integrated perspective.

Debt Elimination and Refinancing Services

Your Experior Financial Associate will help to develop a comprehensive plan to become debt free.

Investing

Creating secure futures begins with a financial foundation.

Retirement

Planning for the retirement life you desire.

Children’s Education Planning

The expert financial analysis helps you plan for your children’s education needs

Long Term Care

Cover those risks which can surprise us in life.

Travel Insurance Medical

Coverage that takes risks and worries out of your travel while out of the province or out of the country.

Asset and Income Protection

The entire spectrum of risk is covered: Life, Health and Disability Insurance Protection for today, while you plan for tomorrow.

Wealth Management

It is one thing to build wealth, another to manage your assets. Experior Financial Group Associates believe in asset management by using the best asset managers in the financial industry.

*originally found at https://www.experiorfinancial.com/expert-financial-analysis/