When the market drops as it has in 2022, it raises many questions for us.

As people lose value, the big question is, will it ever come back?

History can help us understand and guide us forward. Yes, the past is not a guarantee of the future, but there are trends and lessons we learn from.

Two charts can be helpful in the conversation.

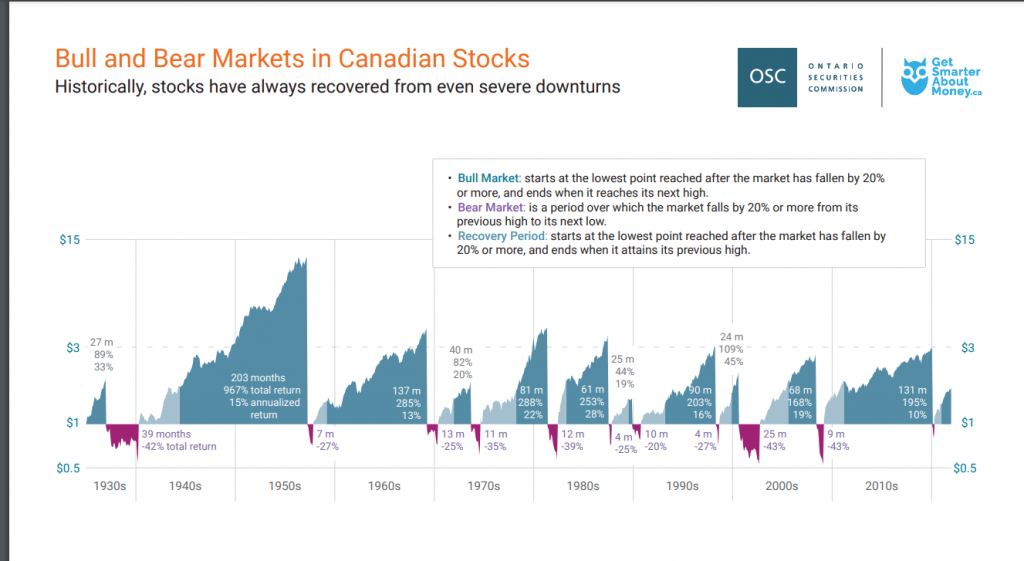

The first is from getsmateraboutmoney.ca and compares bull and bear markets in Canadian Stocks.

You can get a pdf copy here – https://www.getsmarteraboutmoney.ca/wp-content/uploads/2022/04/bull-and-bear-markets-in-canadian-stocks-chart.pdf

As you will see, historically, stocks recover from downturns even when they are large.

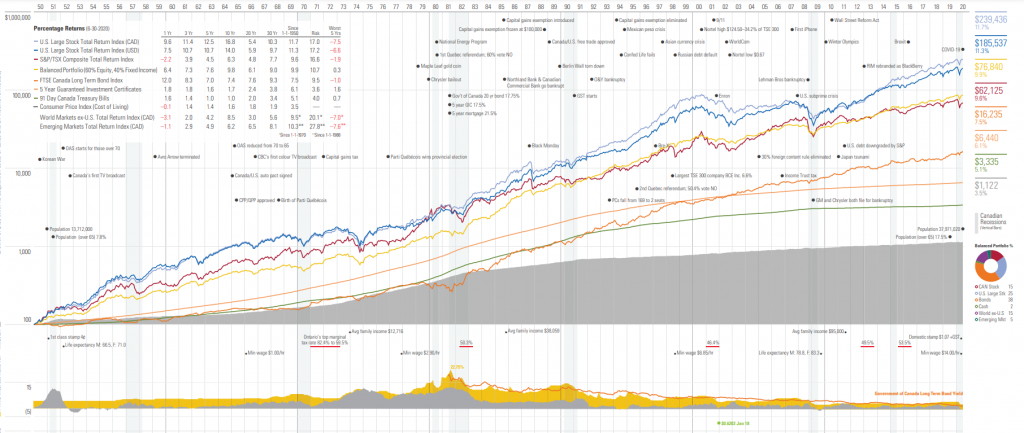

The second is the Andex chart, it tracks the performance of the stock market over time. It looks at the ups and downs and world events.

Yes, perhaps we are in a unique situation, but in some respects, we are not. We have seen many challenges over the years and many downs over the years. This chart shares with us that every time the value comes back. Sometimes it takes longer than others, but it will experience growth.

We need to understand our tolerance for the natural ups and downs of the markets. We may need to adjust our investments based on time, risk, goals and needs.

A few weeks before writing this, an individual I met at a summer festival came up to my table. We started talking about investments and he shared what I believe is some sound wisdom. He shared, “I have been investing for a long time and seen some big drops over my time. I think I will stay in the market because it will turn. It may take some time but it will.” He was sharing his experience.

What question do you have?

Want to learn how to protect your investments for your beneficiaries and lower some risks? Set up a 15 min zoom call, and let’s chat.