Webinar – 3 Question to ask when looking for life insurance

Are you looking for insurance? In this free webinar, I will discuss three questions to ask when looking for life insurance.

Are you looking for insurance? In this free webinar, I will discuss three questions to ask when looking for life insurance.

Is my work-life insurance enough?

Work-Life insurance is part of the group benefits one gets from work.

This is a blessing and essential in caring for your family in case that something should happen.

The biggest asset you have is your ability to work and earn income.

The problem is, it is not enough? Many only provide 1 to 2 times your yearly salary. That is just not going to be enough.

Life insurance is about replacing income for those who are dependent upon you. So what happens after those two years. For many people, that work insurance will not even be enough to pay off the mortgage.

Life insurance is part of an excellent financial plan. It can be used pay for

debt

mortgage

loss income

kids education

estate planning

Let me help you find affordable life insurance that meets your needs.

Q.Should I invest in an RRSP or TFSA?

First, let’s review RRSP and TFSA

Retirement. Many see the TFSA and think it is about savings. That is not the whole truth. An RRSP and TFSA are two great tools to plan for your retirement.

The Key to remember is with an RRSP you are differing to pay income tax to the future. The advantage there is when you go to withdraw it, you will be in a lower tax bracket. So you will pay less tax.

Money put into a TFSA has already been taxed. Any increase in your TFSA investment, you are not taxed on that. You also can withdraw tax-free.

If you are starting out and already in a lower tax bracket, start with a TFSA. The reason is this allows you to save contribution room for your RRSP when you are making a higher income.

When you put money into an RRSP, this brings down the amount of gross income you are taxed on for that year.

An RRSP is taxable when you withdraw it, and a TFSA withdraw is not taxed.

If you withdrew from an RRSP before retirement, you will lose that contribution space and have to pay taxes on it what it is taken out.

If you withdraw from a TFSA, you will not pay taxes. However, you can put the contribution limit back in the following year.

Some institutions advertise the TFSA as a saving account, but it is more than that. First, remember the purpose is retirement. Second, you can disperse the assets in the same places as a RRSP.

Both can invest in cash, GIC, savings bonds, mutual funds, ETF, equities, etc)

Remember investing should be part of a holistic financial plan.

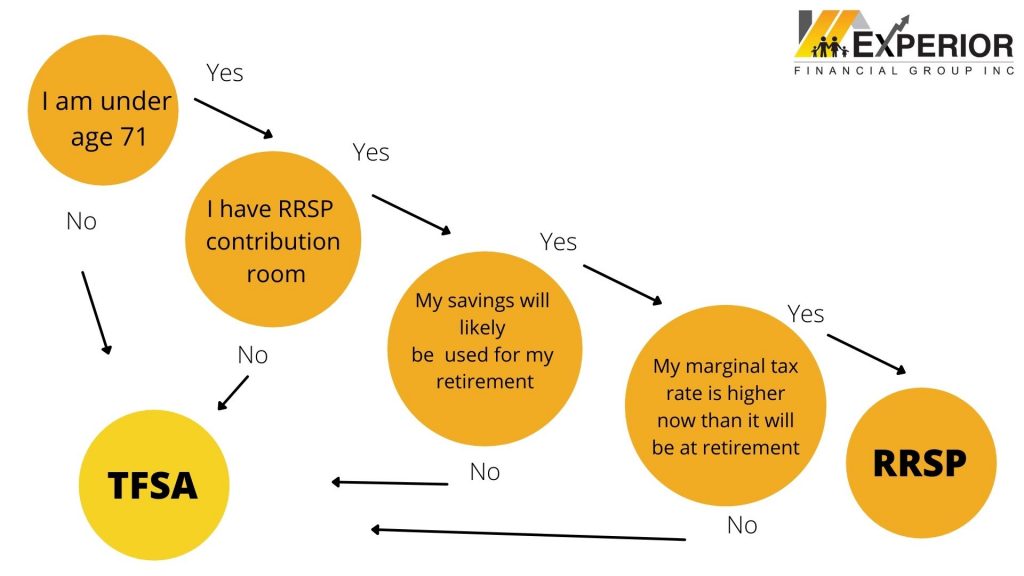

This image though not complete can give you a start in figure out which direction.

Do want to learn how you can have great returns and have a death beneficiary’s benefit on your TFSA or RRSP?

Want further help with TFSA or RRSP?

Just Got questions.

Let’s meet.

The best time to start investing was yesterday; the second-best time is today.