What is a segregated fund?

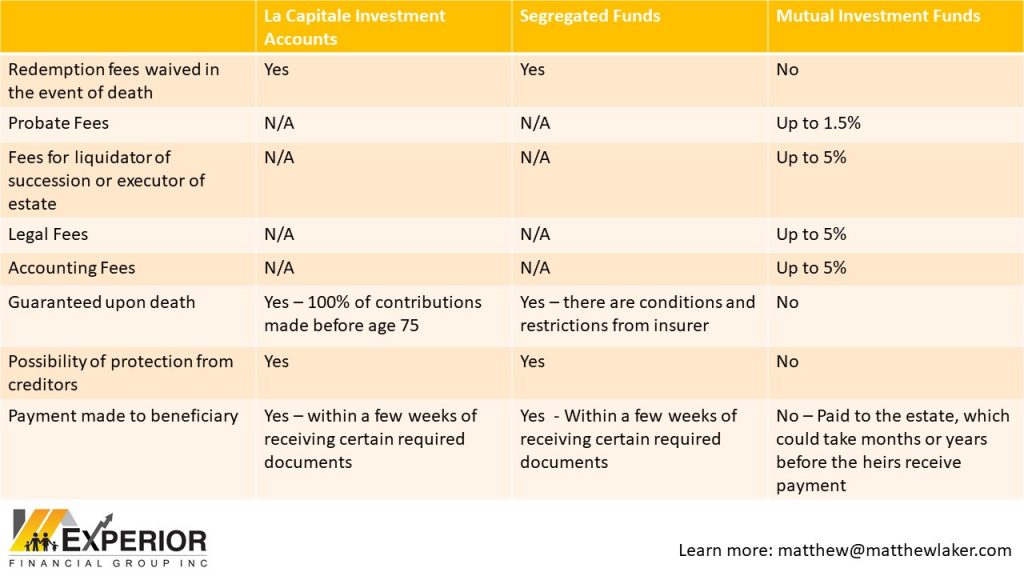

A segregated fund is an insurance product exclusively distributed by insurance companies. It is similar to a mutual fund but provides, among other features, protection against market downturns, by guaranteeing 75%

to 100% of the amounts invested at maturity or death. This guarantee, which is not available for mutual funds, represents a major advantage for some clients as it may limit the risks of loss

Who are segregated funds for?

Segregated funds are for people of all ages. They can be an ideal option for:

— People approaching retirement who want to protect their retirement savings

— People who want to simplify the transfer of their estate to their heirs

— Self-employed workers or business owners who want protection in case of bankruptcy or lawsuits

— Anyone looking for financial peace of mind

.

https://calendly.com/matthewlaker/60min

(*information comes from Industrial Alliance material)