Doing end of life planning helps your family know your wishes.

Estate planning – Help with your Estate planning

“It does not do to leave a live dragon out of your calculations, if you live near one.” – J.R.R. Tolkien

Estate planning is about assessing the risk and ensuring that your wishes regarding your assets take place.

Help for Estate planning

Here is how I am uniquely positioned to deliver solutions in Estate planning.

Assets Value Protection

In the example below, notice from 2007 to 2009 the difference in the market.

The market goes up and down. That is normal. The death benefit means that your beneficiary has the potential of getting a higher value.

Cost

Many of us do not think through the cost of death, but it is a reality that our families will face. By making a plan, we can work together to bring down those costs and lower the taxes paid by your estate or family.

Control

If you have no plan, the government will decide what happens to the things you worked hard for. This is about taking control and stewarding the resources you have.

“If you don’t know where you are going, you’ll end up someplace else.” – Yogi Berra

Creditor Proofing

This works to protect your assets from creditors in case something should happen later in life.

I can help you create a plan to leave a legacy for your family.

Let’s meet.

I do not need life insurance I will use my savings

I do not need life insurance; I will use my savings?

What happens when I die to my savings.

If I have savings in a bank

- Suppose your accounts are joint accounts. Then the joint name on the account has access to it.

- If the one who passed is the sole name on the account, then more often than not, the account gets frozen. Then the will and estate have to go through probate before the funds are freed. Let’s be clear this is going to take time.

RRSP/RIF and TFSA

- If you have a beneficiary listed, they will transfer to them.

- There could be tax implications for the one receiving, and one needs to be careful they do not go over their limit.

Example of tax

- person dies in June, and money is not transferred until December, and an increase in value occurs. One will pay tax on that increase.

- If no beneficiary listed you, it will go to the estate and maybe subject to probate.

Benefits of a Segregated fund through an insurance company

- TFSA and RRSP, and RRIF can be purchased through insurance segregated fund products.

- They are very competitive with mutual funds.

- Money passed to the beneficiary is outside the estate and tax-free.

- Using a segregated fund allows for the transfer of the assets to a successor with no tax impact as shared above.

- If the account value has dropped below the last account value reset, you will benefit and receive the higher amount.

- Make sure spouse is listed as a beneficiary to receive the death benefit options with Segregated Fund.

Finally, final expense insurance helps cover costs associated with dying, ensuring your family gets help fast and or a little extra.

Let’s start with a free financial analysis of where you are and what you need and get a plant that fits your uniqueness.

Estate planning – What is a Segregated Fund?

Why would you even look at a Segregated Fund?

Segregated Funds are one good tool to help in Estate planning. Especially if you have money set aside that you want to leave to a certain beneficiary. Some individuals may like the security that comes with the death benefit.

What is a Segregated Fund?

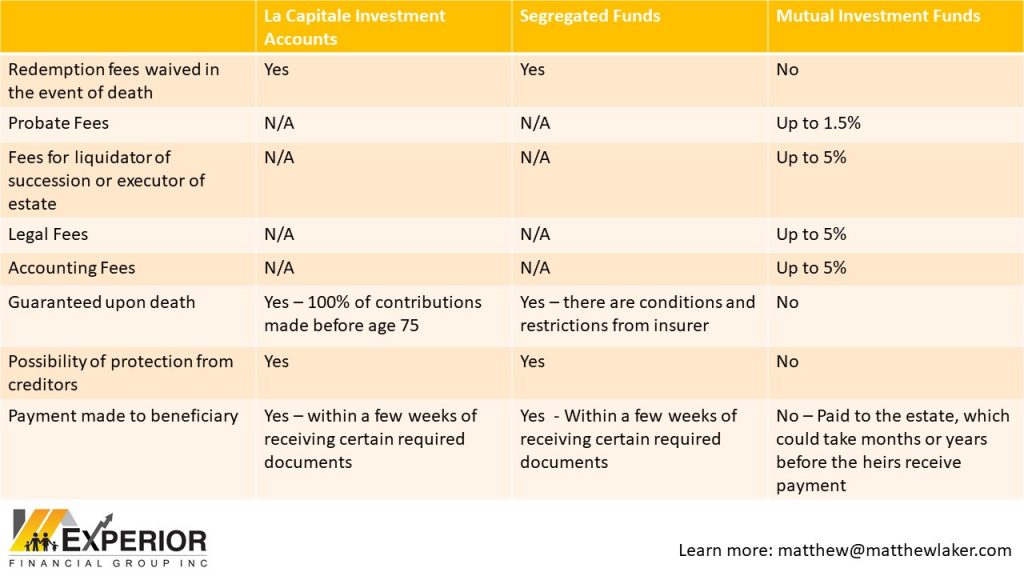

Segregated funds are offered by insurance companies and have some uniqueness and characteristics that do not apply to traditional mutual funds. They combine the growth potential of investments with insurance protection.

Many provide a guarantee to protect the principal of the money you invest, Even if the fund loses money, you will get back a portion or all of your principal investment. There are also resets along the way, the reset is a guarantee on the current value if you should die. However, you have to hold your investment for a certain length of time to benefit from the guarantee.

Here are seven uniqueness of Segregated Funds.

- Guarantee in the event of death and upon maturity.

- Potential to lock in Growth – This is a reset option on the growth of the investment, it becomes the guarantee upon death.

- Investments are exempt from seizure by creditors. -This can be helpful for those with a business wanting to protect assets.

- quick access to investments in the event of death. – There is no need to go through probate, and your beneficiaries can receive the money sooner.

- Increased level of confidentiality. – These can be important for those who do not want people to know how much their assets are. As it is not part of the public record.

- Avoiding probate. – Probate can eat up a percentage of the estate, that is not the case with segregated funds.

- Assuris protection (https://assuris.ca/how-am-i-protected/assuris-protection/wealth-management/individual/guarantees-on-segregated-funds/) – In the event that the company fails, this organization provides protection for Canadian policyholders, protecting their guarantee.

Are Segregated Funds for you?

Perhaps, perhaps not. It depends on what are your goals and needs.

This is why you need to do a Financial analysis that looks at your needs, current situation, goals and what are your options. Each person needs a financial plan unique to them.

I can help you with that. Let’s start with a free 60 min meeting and walk you through our complimentary financial analysis. This will confirm where you are at and where you want to go and what your best options are and create a plan to get there.

Fill out the form now, why wait, it will cost you nothing and give you the assurance of what your next steps need to be.

Work with me

4 Steps to our Financial coaching.

1. A Complimentary Financial Analysis

2. Help you Create a Game plan

3.Put the plan into action

4.Annual Review