7 reasons to change your life insurance or review your policy.

Six advantages of a Financial advisor

How can having a financial advisor help? When I speak with people I often share with them I am really a financial coach. I get to come alongside and help people reach their goals. A financial advisor should be the same. Here are six ways a financial advisor/coach can help.

1.Setting and achieving planning targets

Have a coach can help you gain focus and stay on track. A good financial advisor is a coach that helps you clarify your goals and create a plan to reach your targets.

Those who have a financial advisor tend to have higher investable assets as compared to non-advised households. As well increased Accumulation of financial wealth regardless of income level or age of household

2. Choosing the right vehicles and plans:

Often some of the challenges in building our financial house is finding the correct vehicle to help us reach our goals. A good financial advisor/coach will show you the options. Make sure you ask lots of questions on why this option or that one.

3. Advised households save more, regardless of income and age than their non-advised peers.

There is something about a coach that keeps us on track. We all make many of our choices based on emotion and may want to go do something not in the plan. The coach can remind us of our why our goals and why this plan. Any good plan has to be massaged over time, but those with advisors tend to make those changes.

4..Setting the right investment mix:

Having diversification is important for proper success in investment. Many will want to jump on the new thing or chase daily numbers. As a financial coach/advisor for my clients, I want to make sure my clients have a good mix so if one part is losing money the rest are making money and they are still ahead.

5.Financial Literacy

Education is an important part of financial advise/coaching. Having access to an advisor who is keeping up with training and education means they get to pass that knowledge on to you.

6. Advantages of a Regulated Market

Here in Canada each financial advisor, those selling life insurance and investments funds are regulated by a few oversight organization that work to make sure clients are put first and ethical.

Source: http://www.ci.com/web/pdf/ific_value_of_advice_e.pdf

Work with me

4 Steps to our Financial coaching.

1. A Complimentary Financial Analysis

2. Help you Create a Game plan

3.Put the plan into action

4.Annual Review

Setting Financial Goals in your Marriage

Many couples have different ideas about money and other topics. Many just focus on short term goals and do not think about longer goals. One of the best things you can do is sit down and come to the same page.

Steps to strengthen your marriage and set financial plans.

Grab the Marriage and Financial Goals pdf exercise.

- Schedule an hour of undisturbed time.

- Take the pdf and print one for each of you.

- Take the first 15 minutes and answer the questions.

- Short term Goals (six months to one year)

- Long term Goals (one to five years)

- Now it is Discussion time. Come together and work through the following questions.

- Each take your list and share it back and forth. Do not discuss if you can do it; just listen to each other.

- What is the difference, and what is the commonality?

- Decide together as a couple on your shared goals.

- Talk about how each of you will contribute to making this happen.

You are not alone in this journey. Here is where I can help. I can help you develop this financial plan and financial foundations for your family and empower you today.

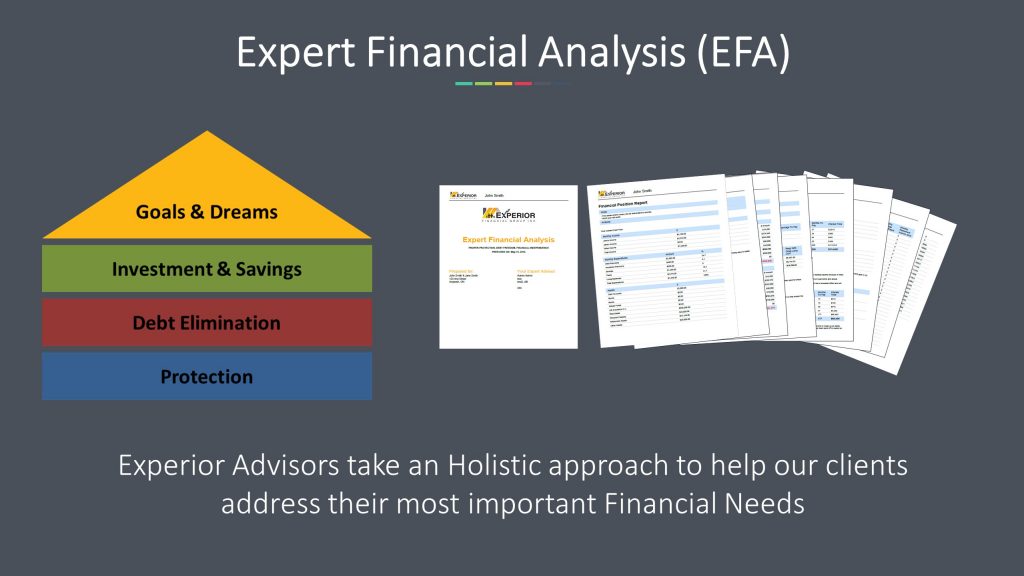

3 reasons why you need to do a financial analysis?

Why do you need to do a financial analysis?

It simple, to find out where you are at so you can reach your financial goals.

However, it is not good enough to stop there. You need to have a plan and work on the plan.

An Expert Financial analysis should provide all that.

Three reasons, why you need to do a financial analysis with Experior.

First, it helps you find out just where you are at financially. Get it on paper.

Second, it lays out a plan of action, a place to start, and a pathway. I understand some may not, but ours does.

Learn about building a solid financial house and get our complimentary Financial Analysis.

Three, its time to master your money and not let it master you.

Do you have a plan?

Have you reviewed that in the last six months?

What resources have worked for you?